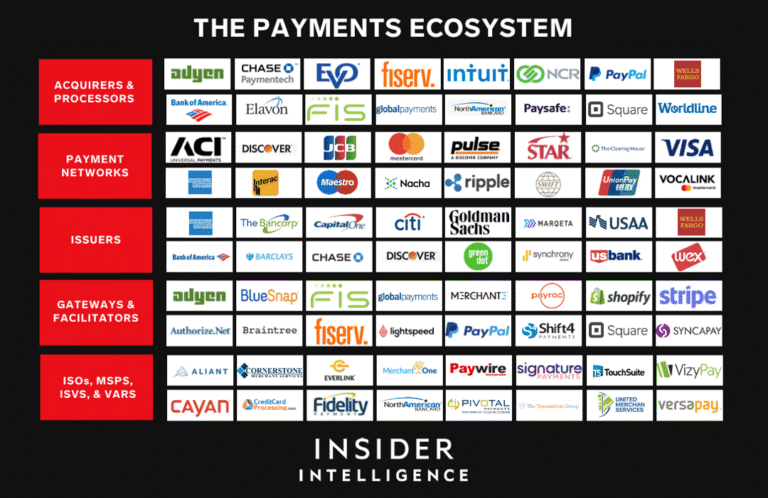

digital payment ecosystem

Payments have evolved from a supporting function into one of the most critical layers of the financial system. Today, value moves through interconnected networks that link banks, payment service providers, merchants, governments, and end users. This structure is commonly referred to as a digital payment ecosystem.

According to the Bank for International Settlements (BIS), digital payment instruments and fast payment systems have become a foundational component of modern financial infrastructure across both developed and emerging economies.

Rather than operating in isolation, payment services now depend on interoperability, shared standards, and real-time processing capabilities. These characteristics define the modern digital payment ecosystem.

What defines a digital payment ecosystem

A digital payment ecosystem is not a single product or platform. It is a coordinated environment where multiple actors interact through shared technological and regulatory frameworks.

At a minimum, such ecosystems include:

- Account-to-account payment rails

- Card and wallet interoperability

- Real-time or near-real-time settlement

- Secure identity and authentication layers

- Integration with financial institutions’ core systems

The BIS emphasizes that payment ecosystems work best when they are interoperable, resilient, and accessible to a wide range of participants, including banks, fintechs, and public institutions.

Digital payments and global adoption trends

The growth of digital payments is not anecdotal. It is supported by global adoption data collected by international institutions.

The World Bank reports that the use of digital payments increased sharply worldwide following the COVID-19 pandemic. As of its latest analysis, a majority of adults globally now make or receive digital payments, either through mobile devices, cards, or account-based systems.

This surge has reinforced the need for payment ecosystems capable of handling high transaction volumes while maintaining security and reliability.

Interoperability as a foundation for scale

One of the defining features of a successful digital payment ecosystem is interoperability. Systems that allow participants to transact seamlessly across institutions tend to scale faster and achieve higher adoption.

The BIS highlights that interoperable systems reduce fragmentation, lower transaction costs, and increase competition by allowing multiple providers to coexist on shared infrastructure.

This is particularly important in markets where multiple banks and non-bank providers serve large and diverse populations.

Brazil’s Pix: a national digital payment ecosystem

Brazil’s Pix system offers a clear example of a digital payment ecosystem operating at national scale.

Launched and governed by the Banco Central do Brasil, Pix enables instant payments between individuals, businesses, and government entities, 24 hours a day. The system is open to banks and regulated financial institutions, creating a unified payment environment.

Official information published by the Central Bank explains how Pix operates, its governance model, and its role in Brazil’s financial system.

Pix demonstrates how a centrally coordinated yet open ecosystem can achieve widespread adoption without relying on a single commercial provider.

India’s UPI: ecosystem-driven digital payments

India’s Unified Payments Interface (UPI) represents another large-scale digital payment ecosystem.

Operated by the National Payments Corporation of India (NPCI), UPI allows users to transfer funds instantly between bank accounts using mobile applications provided by multiple banks and payment providers.

NPCI publishes official transaction statistics showing sustained growth in UPI usage, with billions of transactions processed on a recurring basis.

UPI’s success illustrates how standardized interfaces and shared infrastructure can support innovation while maintaining systemic stability.

Security and trust in digital payment ecosystems

As payment volumes grow, so does the importance of security. Digital payment ecosystems must operate reliably at scale while protecting users and institutions from fraud and operational risk.

The BIS identifies resilience, strong governance, and risk management as essential requirements for payment infrastructures that are systemically important.

Effective ecosystems integrate security measures across all layers, including authentication, transaction monitoring, and data protection.

Digital account access and ecosystem participation

Access to a digital payment ecosystem typically begins with account ownership. Without the ability to open and maintain an account, users cannot fully participate in digital financial services.

The World Bank Global Findex Database tracks account ownership and digital payment usage worldwide, showing a strong correlation between access to accounts and participation in digital economies.

Ecosystems that simplify access while maintaining regulatory compliance are better positioned to expand inclusion and long-term usage.

Open ecosystems and long-term adaptability

A digital payment ecosystem must be able to evolve. Regulatory changes, new technologies, and shifting user expectations all require adaptability.

The BIS notes that payment systems designed with modularity and openness are more resilient over time, as they can incorporate new participants and services without disrupting existing operations.

This approach supports continuous innovation while preserving operational stability.

Measuring impact beyond transaction volume

While transaction volume is an important indicator, the true value of a digital payment ecosystem lies in efficiency, accessibility, and reliability.

World Bank data shows that countries with widespread digital payment usage often experience improvements in transparency, cost efficiency, and financial participation.

These outcomes reinforce the role of payment ecosystems as enablers of broader economic activity.

The future of the digital payment ecosystem

As digital adoption continues, payment ecosystems will increasingly serve as platforms for additional financial services. Real-time data exchange, automation, and cross-border interoperability are expected to become standard features.

The institutions that invest in scalable, secure, and interoperable ecosystems today will be better positioned to respond to future demands without rebuilding their foundations.

The digital payment ecosystem is no longer a peripheral element of financial services. It is the infrastructure that supports modern commerce, banking, and inclusion.

By focusing on interoperability, security, and scalability, financial institutions can build payment ecosystems that are resilient, adaptable, and capable of supporting growth over the long term.